Market View from Realm Investment Management. Week ending 12th August 2022.

Stocks and risk-assets rallied last week reinforcing the view of some economists that inflation has peaked. US CPI data came in lower than expected and (along with recent US jobs data) is encouraging bulls that a so-called “soft landing” can be achieved, i.e. bringing inflation under control without causing a damaging recession. (We should note here that although recession in the US is not an inevitability, evidence suggests that in the UK and Europe it almost certainly is.)

Following the data release Fed officials were quick to dampen enthusiasm, reiterating that the central bank will continue raising rates this year. That was the market expectation anyway, but the inflation data might suggest they will not need to be as aggressive as previously thought.

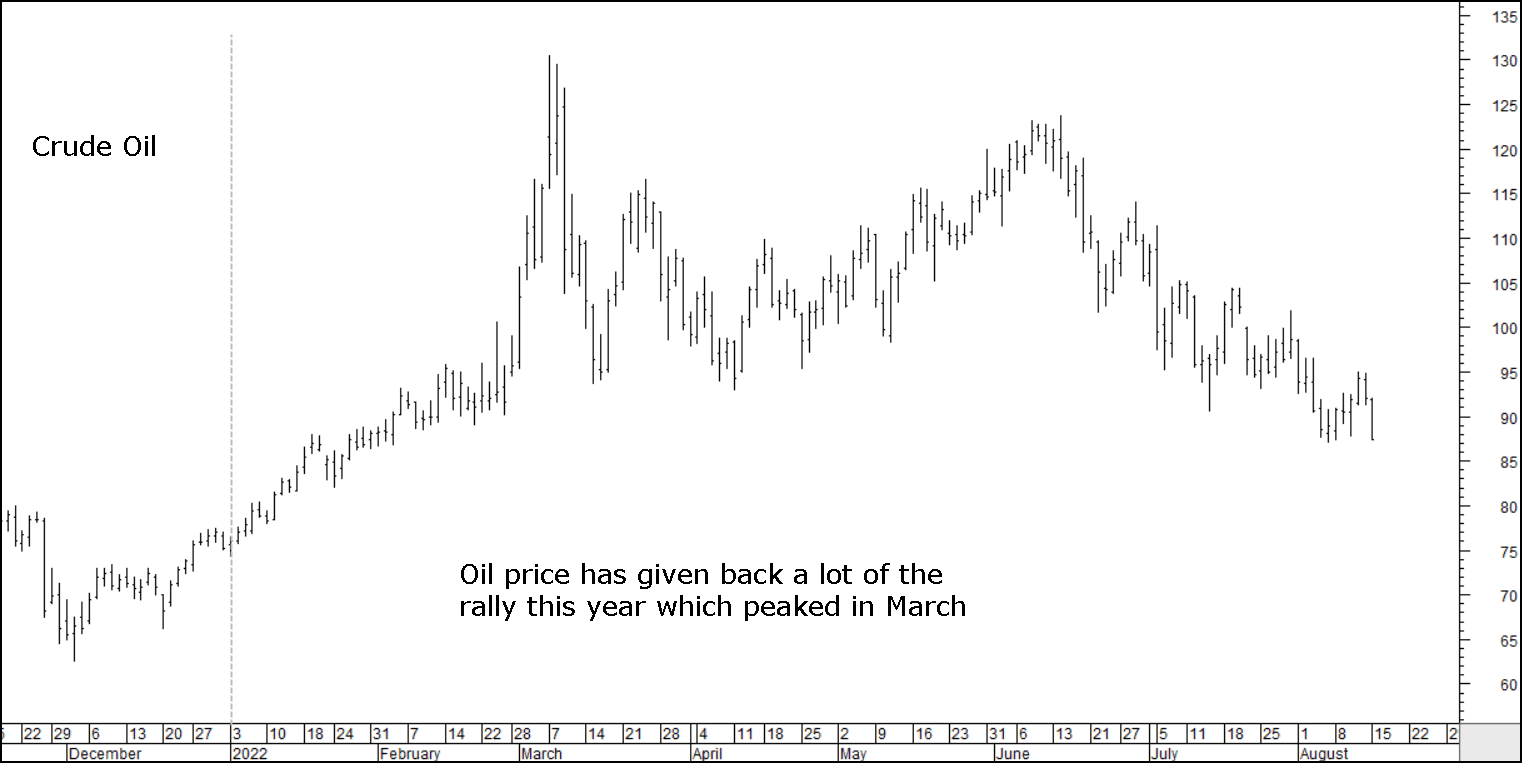

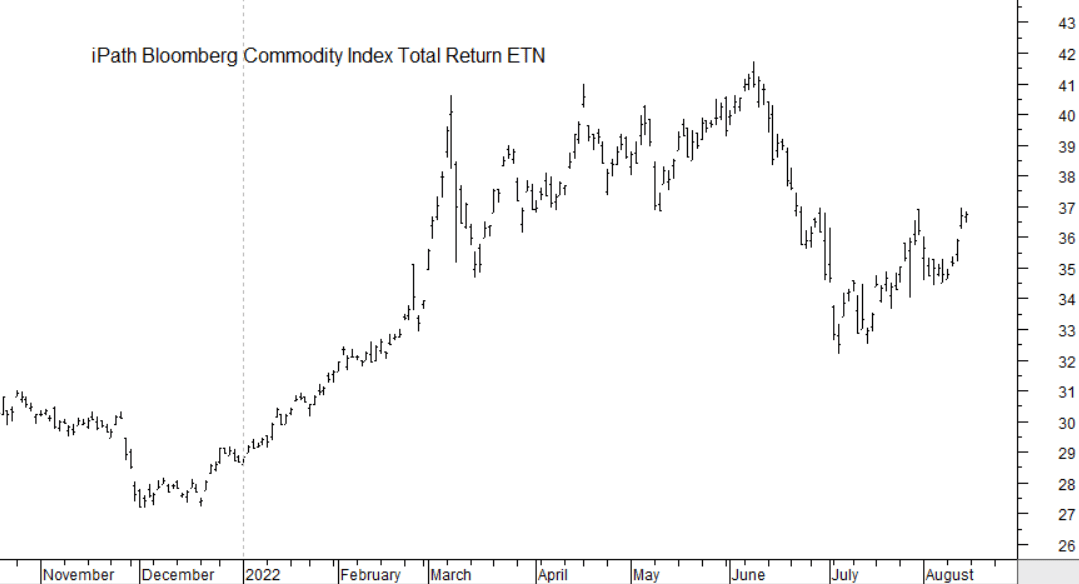

The prices of oil and other commodities were higher last week but the trend over last three months has been down, see charts below. On the plus side, the decline in commodity prices appears to have fed through to the CPI data and indicates that inflation is cooling – hence the rally in equities – but on the negative side the same information indicates that activity (growth) is slowing and that’s maybe not so encouraging in the longer term.

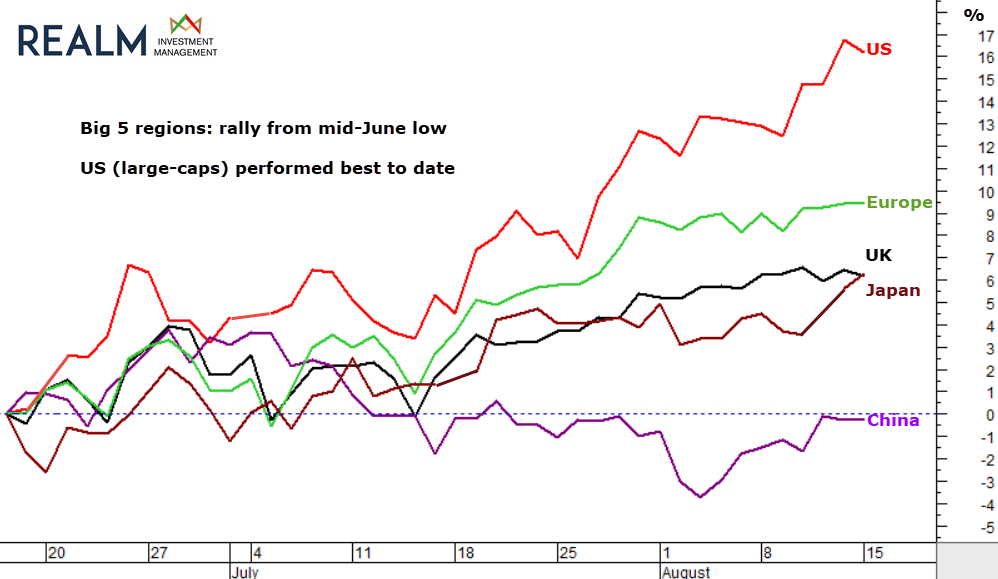

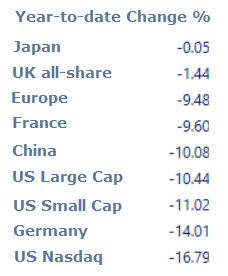

Equity markets in all major global regions have rallied since June, with the US, once again, leading the way with a gain of more than 16% from the low. See chart below.

We also show year-to-date performance numbers below. These do not account for currency and purely reflect the equity index performance for each country.

In the UK, the Bank of England Deputy Governor Dave Ramsden said that further interest rate hikes are “more likely than not” but he has “not reached a firm decision” on that. No doubt further UK data releases this week, including unemployment and retail sales numbers, will be carefully taken into account when weighing a possible BoE rate hike next month.

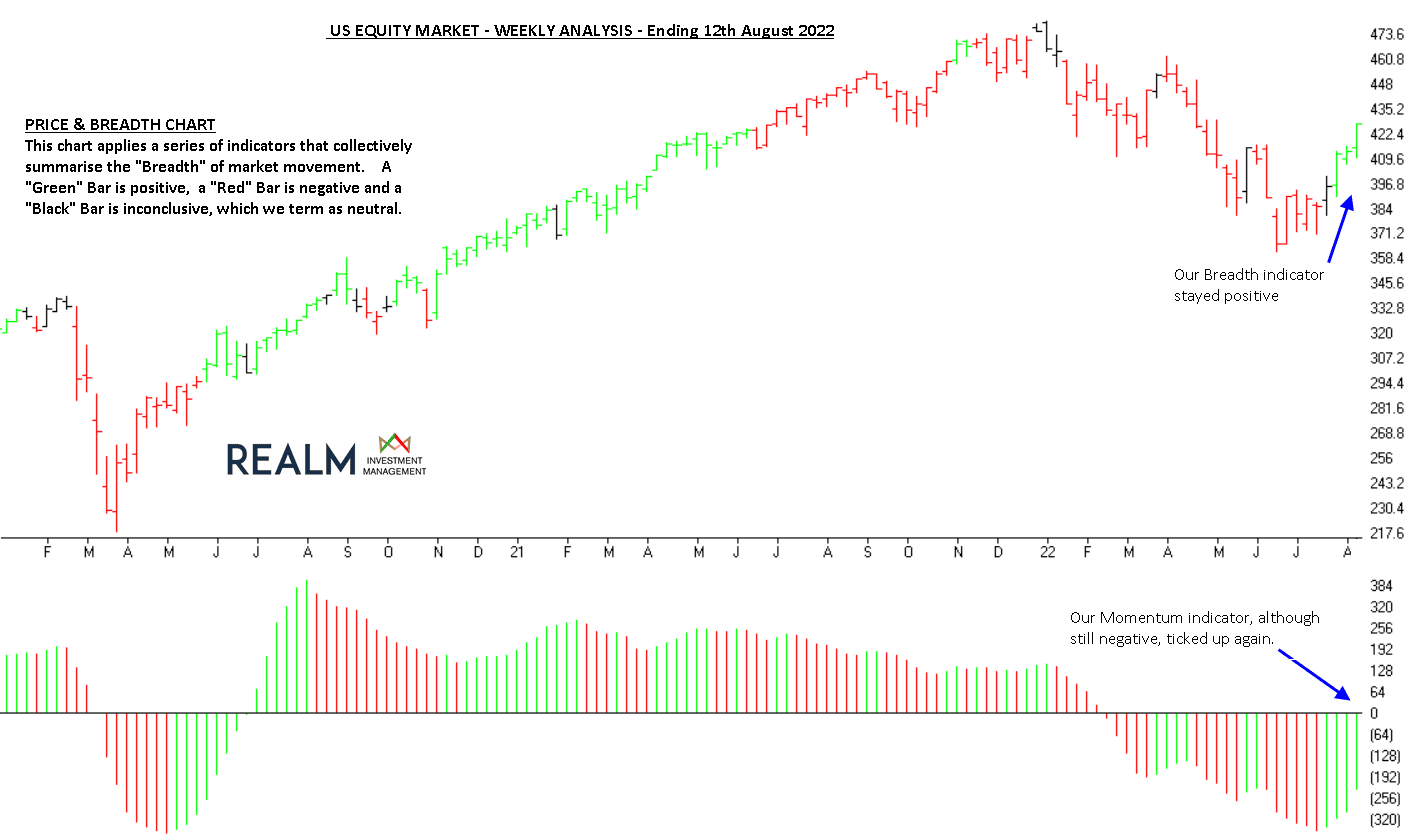

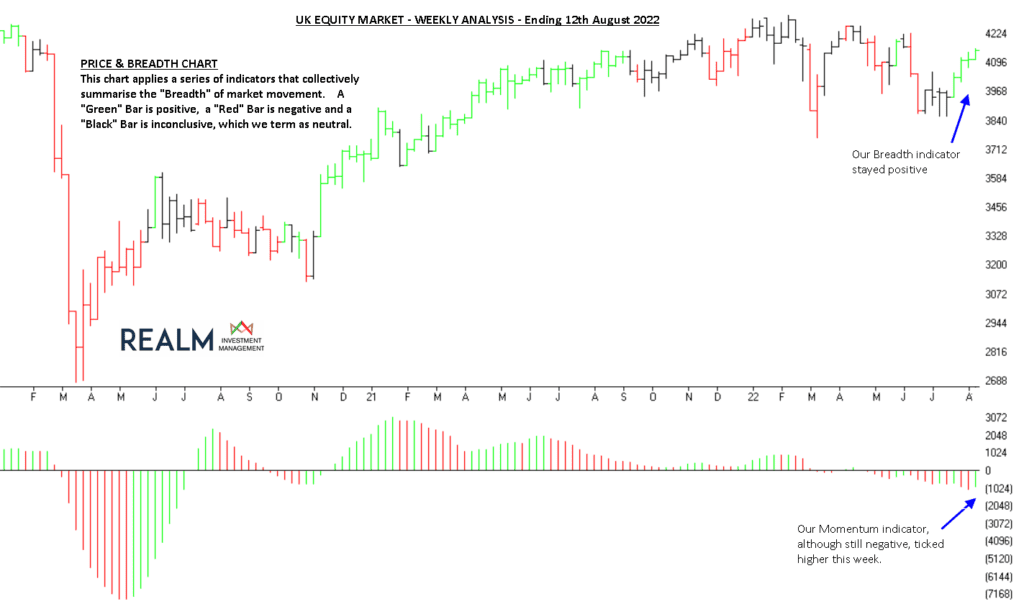

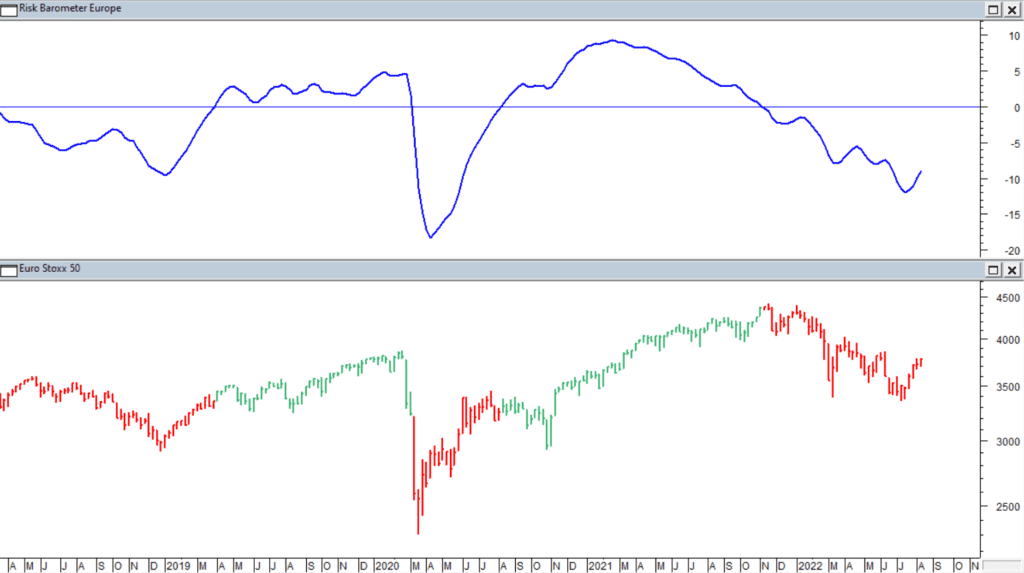

Finally, our Realm Market Charts and Risk Barometers have been showing more strength recently and are now indicating cautious optimism – but they do need to improve further. Bear markets often experience strong rallies and before we can join those calling this rally the birth of a new Bull, we need to see more evidence.

Disclaimer: ‘Where the business has expressed opinions, they are based on current market conditions, they may differ from those of other investment professionals and are subject to change without notice. The information contained within this communication is believed to be reliable but Realm Investment Management Limited does not warrant its completeness or accuracy.

This communication is not intended as a recommendation to invest in any particular asset class, security or strategy. Regulatory requirements that require impartiality of investment/investment strategy recommendations are therefore not applicable nor are any prohibitions to trade before publication. The information provided is for illustrative purposes only, it should not be relied upon as recommendations to buy or sell investments.’