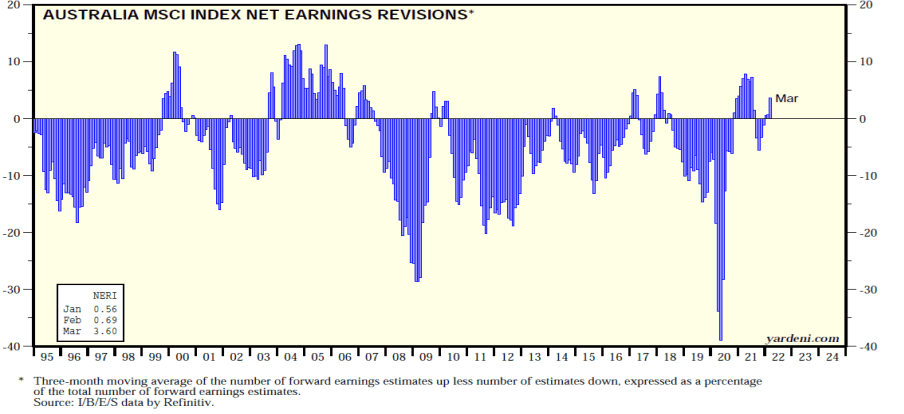

Australia’s EPS revisions are on the rise

Rising interest rates and spiralling commodity prices threaten to derail the post pandemic global recovery. However, commodity exporting economies such as Australia and Canada are set to defy the global trend with strong projected GDP growth. Australia’s Calendar Year 2022 GDP is set to grow by 4%, up from 3.8% in CY 2021, while Canada’s GDP too is expected to rise by about 4% in CY 2022. Also, both these economies have positive net crude and petroleum product exports as a % of GDP, insulating them from shortages and an increase in crude oil prices due to the Russia-Ukraine war.

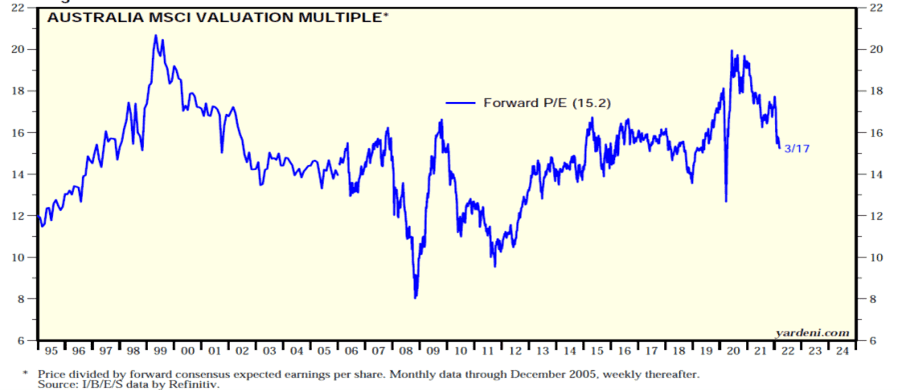

The Australian equity market which is currently trading at an attractive P/E multiple of 15.2X and a dividend yield of 3.5% is starting to witness strong EPS upgrades. Also, strong projected cash flows for the commodities sector in particular, are expected to keep dividend pay-outs healthy (with metal behemoths BHP, Rio Tinto leading the way) while also enabling debt repayments.

Australia equity valuations are attractive

This communication is not intended as a recommendation to invest in any particular asset class, security or strategy. Regulatory requirements that require impartiality of investment/investment strategy recommendations are therefore not applicable nor are any prohibitions to trade before publication. The information provided is for illustrative purposes only, it should not be relied upon as recommendations to buy or sell investments.