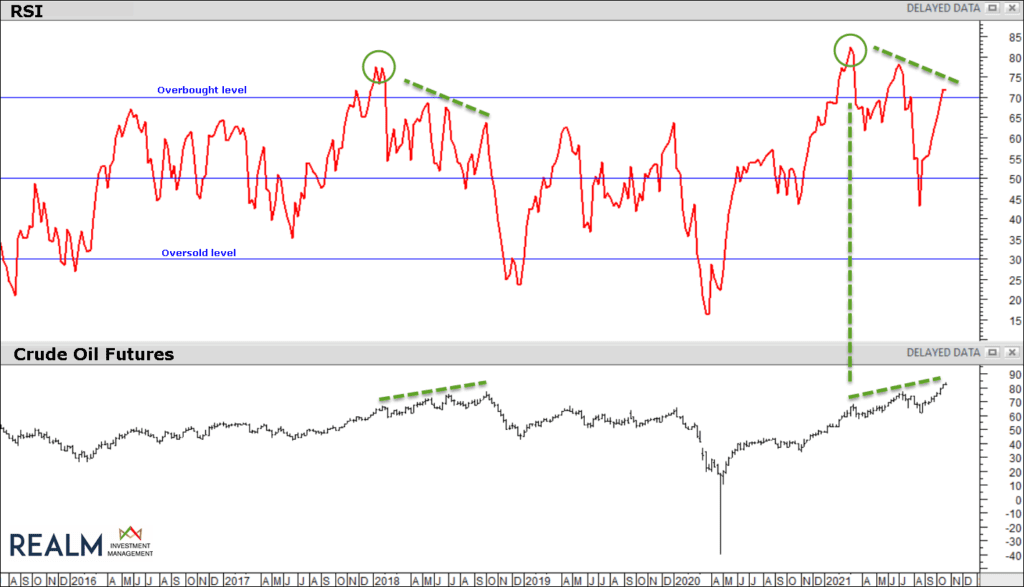

The recovery in the oil price from the 2020 low has been dramatic and this month, as the rally broke out to fresh highs for this bull run, many analysts have warned that technical overbought levels have been reached and profit-taking and a setback may be next.

Looking back over this year and using the popular RSI indicator we can see (graphic 1) that overbought levels have been reached twice before. This was in March and June, and setbacks did follow – the dips were bought on those occasions but will that happen again? and will the longer term trend remain intact? To help us answer those questions we look below at trader positioning and try to get a handle on which way the “smart money” is leaning.

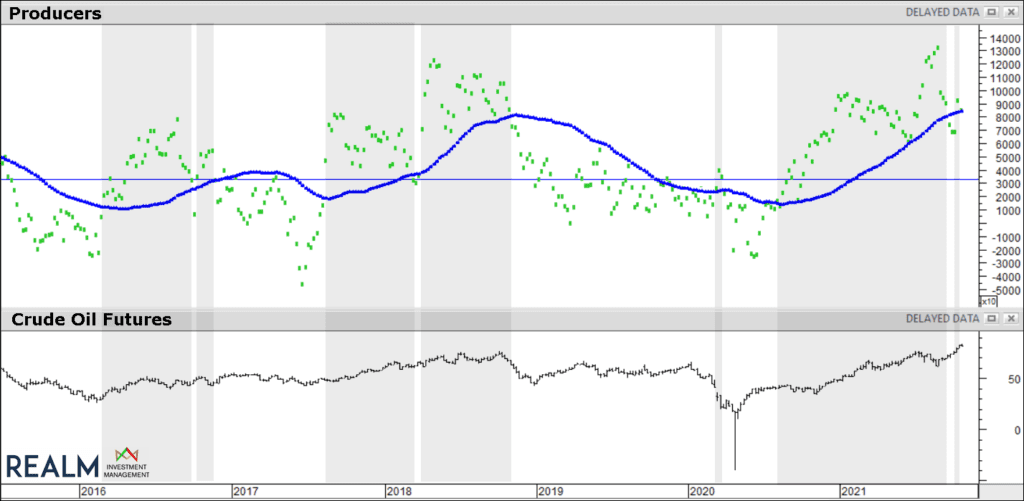

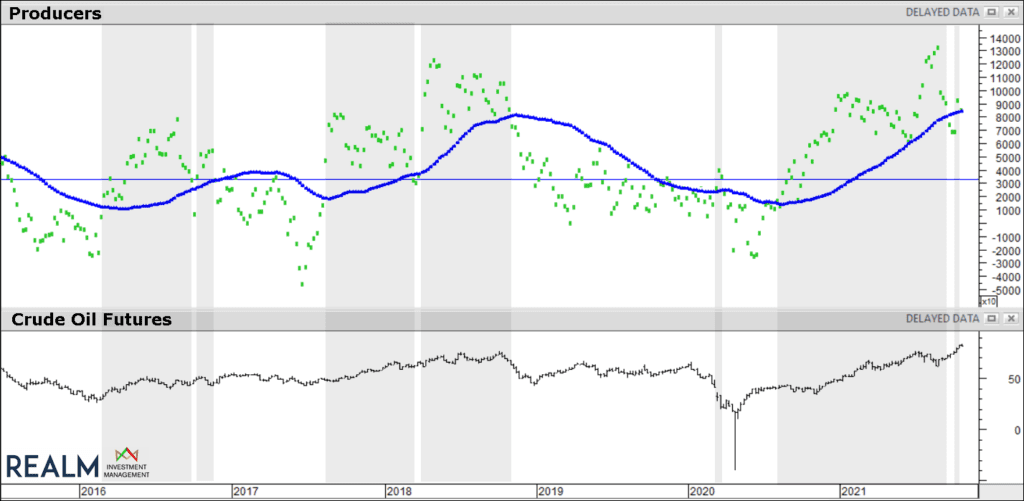

We’re using data from the weekly Commitments of Traders Report, provided by the CFTC (Commodity Futures Trading Commission).

The second graphic shows the net positioning (longs minus shorts) of the Producers category of traders plotted above a weekly chart of Crude Oil Futures. A Producer, as described by the CFTC, is “an entity that predominantly engages in the production, processing, packing or handling of a physical commodity and uses the futures markets to manage or hedge risks associated with those activities“. We can consider these players to be Smart Money.

When Producers net position (in green) is generally trending higher, i.e. above the blue average line, the price of oil tends to rally over the longer term. This condition is shaded on the chart. Note that earlier this month there was a dip below the average line but last week the net positioning jumped back above it.

Our assessment for oil is this: clearly the price trend is up but technical analysis suggests a setback is due noting the overbought condition. However, we would expect any weakness to be bought as long as our Smart Money indicator keeps trending higher.

If you have another look at the charts you will see that from a similar situation in 2018 the Smart-Money position broke below its average late in the year as the oil price began a sharp correction. We’ll be monitoring the oil price closely given the current focus on inflation and hence the impact on the Fed’s tapering timing, and watching particularly the behaviour of the Smart Money.

Disclaimer: ‘Where the business has expressed opinions, they are based on current market conditions, they may differ from those of other investment professionals and are subject to change without notice. The information contained within this communication is believed to be reliable but Realm Investment Management Limited does not warrant its completeness or accuracy. This communication is not intended as a recommendation to invest in any particular asset class, security or strategy. Regulatory requirements that require impartiality of investment/investment strategy recommendations are therefore not applicable nor are any prohibitions to trade before publication. The information provided is for illustrative purposes only, it should not be relied upon as recommendations to buy or sell investments.’